API startup Noname Security is close to finalizing a deal to sell itself to Akamai for nearly $500 million

Noname Security, a cybersecurity startup that is known for its API protection, is currently in discussions with Akamai Technologies regarding a potential sale for $500 million, as indicated by a knowledgeable source. Founded in 2020 by Oz Golan and Shay Levi, Noname Security has its headquarters in Palo Alto but also boasts Israeli origins. Prior to these discussions, the startup had successfully raised $220 million from venture investors and had reached a valuation of $1 billion in December 2021, following its Series C funding round that fetched $135 million, led by investment firms Georgian and Lightspeed. Although the sale's price now might appear to be less than its previous valuation, the current deal on the table involves a cash transaction. However, it’s important to note that this deal is not yet finalized and could either change or not come to fruition at all.

Several investors, including Insight Partners, ForgePoint, Cyberstarts, Next47, and The Syndicate Group have previously invested in Noname. Despite the sale price now being half of what Noname was valued at during its last private funding round, early investors are set to receive a significant return. This scenario also presents an opportunity for later-stage investors, especially those from the recent funding round, to at least recover the capital they invested, even if it falls short of the expected profits from the 2021 investment boom.

Currently, the proposed deal values Noname Security at approximately 15 times its annual recurring revenue. It is also expected that around 200 employees from Noname will be incorporated into Akamai if the sale is successfully concluded. When approached for comments, Akamai chose not to respond, while a spokesperson for Noname Security opted not to comment on what they referred to as 'rumors or speculation.'

Earlier reports from The Information in January and from the Israeli news outlet Calcalist in February indicated that Noname was seeking additional funds at a reduced valuation and was in talks with potential buyers, including Akamai. The recent trend among VC-backed companies, particularly evident after the increase in interest rates by the U.S. Fed, has seen a significant number of these companies reducing their valuations. They are actively seeking new funding or potential buyers in a process known as a dual-track process. This trend is influenced greatly by the current standstill in the IPO market and the venture industry's anticipation of more merger and acquisition activities if the IPO market does not revive.

Why Meta is looking to the fediverse as the future for social media

Why Meta is looking to the fediverse as the future for social media Microsoft’s Surface and Xbox hardware revenues take a big hit in Q3

Microsoft’s Surface and Xbox hardware revenues take a big hit in Q3 Augment, a competitor of GitHub Copilot and backed by Eric Schmidt, emerges from stealth mode with a launch of $252 million

Augment, a competitor of GitHub Copilot and backed by Eric Schmidt, emerges from stealth mode with a launch of $252 million IBM advances further into hybrid cloud management with its $6.4 billion acquisition of HashiCorp

IBM advances further into hybrid cloud management with its $6.4 billion acquisition of HashiCorp Perplexity is raising over $250 million at a valuation of between $2.5 billion and $3 billion for its AI search platform, according to sources.

Perplexity is raising over $250 million at a valuation of between $2.5 billion and $3 billion for its AI search platform, according to sources. Apple announces May 7 event for new iPads

Apple announces May 7 event for new iPads Gurman: iOS 18 AI features to be powered by entirely On-Device LLM, offering privacy and speed benefits

Gurman: iOS 18 AI features to be powered by entirely On-Device LLM, offering privacy and speed benefits Meta aims to become the Microsoft of headsets

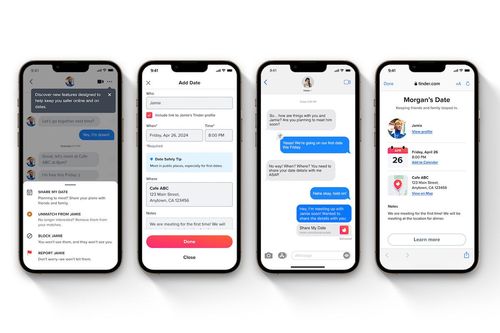

Meta aims to become the Microsoft of headsets Tinder introduces a 'Share My Date' feature allowing users to share their date plans with interested friends

Tinder introduces a 'Share My Date' feature allowing users to share their date plans with interested friends This is Tesla's effective solution for the recalled Cybertruck accelerator pedals

This is Tesla's effective solution for the recalled Cybertruck accelerator pedals