With rumors of a deal circulating, Alphabet and HubSpot represent a strange pairing.

On Thursday, Reuters unveiled that Alphabet, the conglomerate behind Google, is currently investigating the acquisition of HubSpot, a leading company in CRM and marketing automation headquartered in Boston, boasting a market valuation surpassing $33 billion – a figure that's on the rise following these revelations.

Should this acquisition transpire, the financial stakes would be exceptionally high, necessitating a considerable premium on HubSpot's present valuation. This move is speculated to entice HubSpot towards the sale, integrating into the tech behemoth. It's imperative to highlight an existing synergy between the two entities— a collaboration leveraging Google ads to bolster HubSpot sales, often seen as a precursor to acquisition talks.

Historically, Google/Alphabet has showcased a penchant for acquisitions, with its most substantial purchase being Motorola Mobility for $12.5 billion in 2011, which was later offloaded to Lenovo at a significantly reduced price of $2.91 billion. This history, coupled with its recent acquisition of the security intelligence firm Mandiant for $5.4 billion in 2022, illustrates Google's usual fiscal prudence, making a deal of HubSpot's magnitude somewhat atypical.

Moreover, the tech giant's recent austerity measures, alongside a forewarning by Google CEO Sundar Pichai of impending job cuts, cast doubt on the feasibility of such a grand-scale acquisition under the current economic restraint. Nonetheless, with a formidable financial reserve of $110 billion as reported at the year's end, Alphabet possesses the necessary funds for such a venture, should it decide to proceed.

Another potential hiccup in Alphabet's pursuit of HubSpot could be the increasingly vigilant regulatory scrutiny over large acquisitions, particularly in major markets like the U.S., the U.K., and the EU. Examples include Adobe's thwarted acquisition of Figma for $20 billion due to antitrust concerns. Despite HubSpot facing stiff competition from giants like Adobe and Salesforce, the regulatory outcome of a Google-HubSpot deal remains uncertain, with potential termination fees posing an additional consideration.

The ultimate question revolves around the probable success of this acquisition and the unique benefits it would offer both companies beyond their current partnership. As one analyst remarked, while the deal's prospects seem slim, the unpredictable nature of business developments leaves room for possibility.

Why Meta is looking to the fediverse as the future for social media

Why Meta is looking to the fediverse as the future for social media Microsoft’s Surface and Xbox hardware revenues take a big hit in Q3

Microsoft’s Surface and Xbox hardware revenues take a big hit in Q3 Augment, a competitor of GitHub Copilot and backed by Eric Schmidt, emerges from stealth mode with a launch of $252 million

Augment, a competitor of GitHub Copilot and backed by Eric Schmidt, emerges from stealth mode with a launch of $252 million IBM advances further into hybrid cloud management with its $6.4 billion acquisition of HashiCorp

IBM advances further into hybrid cloud management with its $6.4 billion acquisition of HashiCorp Perplexity is raising over $250 million at a valuation of between $2.5 billion and $3 billion for its AI search platform, according to sources.

Perplexity is raising over $250 million at a valuation of between $2.5 billion and $3 billion for its AI search platform, according to sources. Apple announces May 7 event for new iPads

Apple announces May 7 event for new iPads Gurman: iOS 18 AI features to be powered by entirely On-Device LLM, offering privacy and speed benefits

Gurman: iOS 18 AI features to be powered by entirely On-Device LLM, offering privacy and speed benefits Meta aims to become the Microsoft of headsets

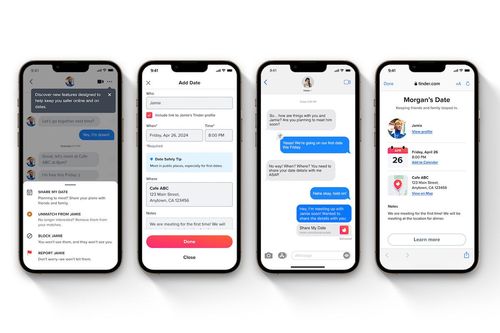

Meta aims to become the Microsoft of headsets Tinder introduces a 'Share My Date' feature allowing users to share their date plans with interested friends

Tinder introduces a 'Share My Date' feature allowing users to share their date plans with interested friends This is Tesla's effective solution for the recalled Cybertruck accelerator pedals

This is Tesla's effective solution for the recalled Cybertruck accelerator pedals